R+R Medicinals is a Colorado based CBD brand that carries a wide range of hemp-based CBD products like gummies, capsules, tinctures, creams, and pet products. I originally discovered R+R Medicinals while researching CBD gummies and thought hey, why not see what they’re all about?

From farm to end-product, it’s all done in Colorado. Their CBD is sourced from locally grown hemp, and extracted in their USDA Organic Certified facility. R+R uses the supercritical CO2 extraction method which retains the vast majority of phytonutrients, terpenes, and antioxidants from the hemp plant. Finally, their three-step filtration process ends with a 1-micro filtration system which ensures that any plant particulate is removed from the oil.

They never use inorganic chemicals or pesticides on their hemp, which is raised using natural growth methods. Every product is third-party tested to ensure potency, safety, and quality. Their lab test results are readily available on their website.

I’ve been using their CBD gummies, capsules, tincture, and cream for the past few weeks and in this review I’m going to go over everything that you need to know about R+R Medicinals CBD.

These products were sent to me by R+R Medicinals for the purpose of this review.

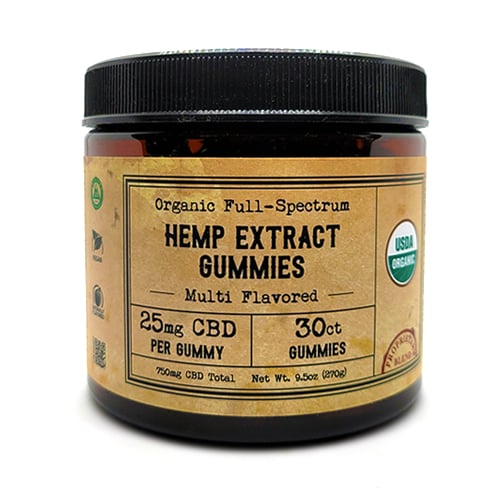

R+R Medicinals CBD Gummies

R+R’s CBD gummies are unique in the industry because they partnered with a candy manufacturer to create them, and are they ever tasty! They are soft, chewy, slightly sour, and sweet. They look like peach rings and come with three flavors in each jar; palisade peach, alpine strawberry, and granny smith apple.

These are easily among the best CBD gummies that I’ve tried. There is some hemp taste when you initially put a gummy in your mouth, but this is quickly overpowered by the tasty sweet and sour flavors. I can definitely tell that they teamed up with a candy manufacturer to make these because I wanted to eat them like regular candy. I had to really hold myself back from eating the entire jar at once!

Their gummies are infused with USDA organic full-spectrum CBD. Each gummy delivers 25mg of CBD and 0.5mg of minor cannabinoids like CBC, THC, CBDv, and CBG for the full entourage effect, which also includes terpenes and antioxidants. As an added bonus, these gummies are also vegan!

You’ll notice that these do have THC in them, however the levels fall below the federal threshold set for THC (0.3%). If you would prefer no THC at all, R+R Medicinals sells THC-Free gummies that use broad-spectrum CBD and contain non-detectable levels of THC according to third-party testing.

R+R Medicinals CBD Tincture

R+R Medicinals currently has one flavor of THC tincture, mint, and one unflavored option. These tinctures are meant to be taken orally and unlike CBD ejuices, cannot be vaped. These tinctures are USDA organic certified and contain full-spectrum CBD which also gets you a host of minor cannabinoids such as CBC, THC, CBG, CBDv, CBL, and CBN for the complete entourage effect.

Their tinctures come in 30ml (1 FL Oz) bottles and are available with either 500mg, 1000mg, or 2500mg of CBD per bottle. One serving is 1ml or 40 drops, and this is labeled on the dropper that is attached to the cap. This makes it easy to dose appropriately. Each serving of the 500mg strength will deliver 16.67mg of CBD and 2mg of the minor cannabinoids listed earlier.

Like their other products, their CBD Tinctures contain all organic ingredients and natural flavorings. They contain organic MCT Oil from coconut as the carrier oil for the CBD, and organic natural mint for the flavoring.

I’ve been using their 1000mg tincture in fresh mint flavor and have really enjoyed using it. It’s not overpoweringly minty like I expected, but instead a subtle fresh mint taste that compliments the nutty hemp flavor nicely.

I’ve been taking this tincture sublingually (under the tongue) and so I’ve found that the hemp flavor is not as prominent as their gummies. However, to compare apples to apples, this hemp taste is more subtle than tinctures from other brands that I’ve tried. If you don’t like the taste of hemp but still want the positive effects, this could be the product for you.

You’ll notice that these do have THC in them, however the levels fall below the federal threshold set for THC (0.3%). If you would prefer no THC at all, R+R Medicinals sells THC-Free tinctures that use broad-spectrum CBD and contain non-detectable levels of THC according to third-party testing.

R+R CBD Softgels

These CBD softgels are a lot like their tinctures, but for some people the softgel form may be an easier and more desirable way to take CBD. They are tasteless and go down easily with some water — perfect if you don’t like the taste of hemp.

There are some trade offs using these softgels instead of the tincture, though. As stated on their website, these soft gels contain less carrier oil and typically have a slower onset of effects, but these effects will last longer, especially if taken with food. I personally did not notice a real difference in effects when I took the softgels instead of the tincture, but everyone’s body is different. For me, I found that these worked just as effectively and made me feel more relaxed and calm all the same.

These softgels use a soft gelatin coating for the shell of the capsule, and contain purified water, MCT coconut oil, vegetable glycerin, and hemp extract. Each bottle comes with 34 softgels, and each one contains either 15mg or 30mg of full-spectrum CBD, as well as 3mg or 6mg of minor cannabinoids.

You’ll notice that these do have THC in them, however the levels fall below the federal threshold set for THC (0.3%). If you would prefer no THC at all, R+R Medicinals sells THC-Free softgels that use broad-spectrum CBD and contain non-detectable levels of THC according to third-party testing.

R+R Medicinals Hemp Extract Infused Cream

R+R carries one type and strength of CBD cream and this is their Hemp Extract Infused Cream with 1000mg of CBD in a 2.5FL Oz squeeze tube. They partnered with a doctor and chemist team to create this cream and ensure that it “delivers high-performance relief with maximum effect”. Neat! This is their new updated formula which they’ve improved upon based on customer feedback. It’s fully vegan, as well as fragrance, dye, and menthol free.

Since I don’t have any chronic pain (thankfully), I like to use hemp creams for their moisturizing effects so I love that these don’t contain menthol. The fragrance free aspect is great too. All I smell is a very light and subtle, nutty hemp scent but it’s not strong at all. Their cream contains ingredients like Arnica Montana, MSM, Calendula Flower, and Jojoba which is then combined with their full-spectrum hemp extract.

Each quarter-sized amount delivers roughly 33.33mg of CBD and 4mg of minor cannabinoids, including THC. There is no THC-free version of their cream.

The consistency of the cream is not very thick, so it spreads easily. It rubs into the skin very easily and doesn’t leave my skin feeling oily or greasy at all. The area I apply it to (usually my legs) ends up feeling moisturized and soft, just what I’m after with a CBD cream. The consistency of the cream is not very thick, so it spreads easily

Other R+R Medicinals products

The products that I covered above are the majority of what R+R Medicinals offers, however they do have one more category of CBD product that I did not touch on — pet products. They offer CBD Dog Chews, CBD Cat Chews, and a CBD Pet Tincture which are natural ways to offer some calm or pain relief to your furry friend.

Verdict

As far as CBD products go, R+R Medicinals make some of the best. I especially love their CBD gummies for how tasty they are, and their CBD cream for its menthol and fragrance free aspects. Their tinctures and softgels are equally as good, high-quality, and effective, but they’re just not as fun or as tasty to take as their gummies!

R+R’s packaging is attractive but very down-to-earth; their softgels and tinctures come in a cardboard box that is fully recyclable and that’s something that I love to see. Their whole brand presentation comes across as serious about their products, and as a consumer, that’s super important to me.

A last, but very important point, is that their lab test results are readily available on their website for all of their products. They take their testing, as well as the quality and potency of their products, very seriously — something that I always ensure of before purchasing a CBD product.

Their prices are competitive and on the lower-end of what I typically see CBD products priced at, so if you’re looking for high-quality, effective CBD products, R+R Medicinals is a great choice.

Add comment