TribeTokes is a premium CBD brand that carries an assortment of luxury CBD products. Like many CBD brands, they offer CBD tinctures, pain creams, skin care creams, and gummies. They even carry a full line of CBD vapes! But what sets TribeTokes apart from their competition is the premium quality of their products and their equally classy presentation — two important factors that many other CBD brands seem to neglect.

Today, I’m hands-on with the TribeTokes product that I was most curious about: their disposable CBD vape pens. Instead of flavored vapes, TribeTokes lets nature provide the flavor by offering 12 different strains of CBD, such as Mango Haze, Juicy Fruit, and Northern Lights, which are naturally flavored by terpenes.

Aside from the terpenes, their CBD vapes contain only one other ingredient: pure full-spectrum CBD oil. All of their CBD vapes are manufactured right in the U.S.A. in California.

These CBD disposables were sent to me directly by TribeTokes for the purpose of this review.

About TribeTokes

TribeTokes slogan is “Built By Girls, Powered By Plants”. It was co-founded a few years ago by entrepreneur Degelis Tufts Pilla and activist Kymberly “KymB” Byrnes with the goal of growing a tight knit community (or a tribe, if you will) of customers, advocates, and CBD enthusiasts.

TribeTokes’ guiding principle is “Never sell a product you wouldn’t give to your own mother or sister,” and this is reflected in the clean lab test results of their products. Their disposable CBD vape pens contain no mycotoxins, no pesticides, and no foreign materials.

They are made with pure full-spectrum CBD oil to give you the full “entourage effect” of other cannabinoids, not just CBD. Their lab test results let you see for yourself the exact quantity of CBD, THC, CBG, and other cannabinoids, as well as the exact quantities of the various terpenes that characterize each strain.

As I mentioned earlier in the introduction, it’s not just their products that are high quality. Their branding and packaging are similarly alluring and inviting. Their CBD vape pens come in an elegant and stylish gold and white magnet box. You feel like you’re about to open an exclusive designer product that very few are privy to.

TribeTokes Disposable CBD Vape Pens

TribeTokes disposable CBD vape pens come in 12 different strains, each with its own unique flavor profile, thanks to the varying types and amounts of terpenes in each strain. They offer a choice of sativa, indica, and hybrid strains which allows you to choose the right one for your specific needs. For example, you could go with an indica if you’re in search of better sleep, or a sativa if you want to feel more energized.

Each of their disposable CBD vape pens comes filled with a half-gram of full-spectrum CBD distillate (derived from hemp grown and processed in the USA), as well as plant-based terpenes. Each vape pen is on average ~75% cannabinoids, 10% terpenes, and 15% other oils and extracts from the hemp plant.

The exact amount of the CBD and other cannabinoids that make up this 75% cannabinoid content varies with each strain, as does the type and amount of different terpenes. TribeTokes CBD vape pens contain no MCT, PG, PEG, VG, or Vitamin E Acetate.

These vape pens are small and easily concealed or thrown into a pocket or bag. The build quality is excellent; they feel really solid and well-built. They have a soft-touch coating that feels good to the touch and further adds to the solid feel. There’s a TribeTokes logo on the front of each disposable, but there’s otherwise no branding. I think that the TribeTokes logo looks good on it, too.

The bottom of each disposable has the name of the current strain that you’re using, and this is helpful for telling them apart if you have a couple on the go. Also on the bottom of each disposable is a blue LED that lights up whenever you take a draw.

The mouthpiece is also where the coil and CBD are located. This mouthpiece has a dark tint to it that makes it tough to see inside but it’s easy enough if you hold it up to the light. There’s a ton of CBD packed into each one (half a gram), and it looks very pure. The mouthpiece is slightly sloped and very comfortable to vape on.

These disposables pack a built-in 370mAh battery that will last for over a year from first use, so you can pick one of these up and use it slowly over a year if you’re not going to use it all of the time. They’re draw activated and work right out of the box. Just inhale on it to activate and you’re on your way.

The Strains

For the past few weeks I’ve been using 5 of TribeTokes disposable CBD vape pens. I’m going to go over each one and tell you everything you need to know including their exact composition, how they taste, and how effective they are. The five strains I have on hand are: Mango Haze, CBD Birthday Cake Kush, Juicy Fruit, NYC Diesel, and Northern Lights.

Mango Haze (Sativa)

CBD Mango Haze is a sativa strain that contains 54.46% CBD, 10.57% CBG, 0.16% THC, and 5.40% other cannabinoids for a total cannabinoid content of 70.59%. You get the benefits of 7 different cannabinoids with this strain!

It has flavors of spicy and sweet notes that will remind you of mango, hence the name, and it’s rich in the terpene limonene, with caryophyllene and myrcene as well. This strain has a wonderful, unique taste that is discernibly different from the others. I find vaping this strain makes me feel more energetic, more focused, and less stressed.

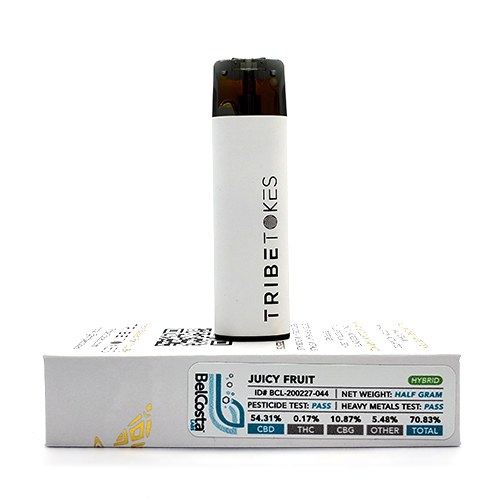

Juicy Fruit (Hybrid)

CBD Juicy Fruit is a hybrid strain that tastes sweeter rather than earthier. It contains 54.31% CBD, 10.87% CBG, 0.17% THC, and 5.45% other cannabinoids for a total cannabinoid content of 70.83%. This cannabinoid content is similar to that of Mango Haze, and it’s similarly rich in limonene, which is the only terpene present in this strain.

I taste slightly sweet notes on the inhale, and it’s very smooth and pleasant to vape on. Vaping on this strain gets me started for the day and helps to keep me focused and on task. It also makes me feel calmer and peaceful. This is a great CBD vape pen to use when you get up in the morning.

NYC Diesel (Sativa)

CBD NYC Diesel is a hybrid strain that tastes very earthy, with subtle notes of pine. It tastes much earthier than Mango Haze or any of the other strains that TribeTokes sent me, and I can appreciate the robust taste. CBD NYC Diesel contains 54.83% CBD, 11.46% CBG, 0.18% THC, and 4.55% other cannabinoids for a total cannabinoid content of 71.02%.

It packs the terpenes terpinolene, limonene, and caryophyllene. I find this strain makes my body feel more relaxed and also slightly boosts my mood. When I’m trying to chill, I find this to be a very tasty and effective CBD strain to vape on.

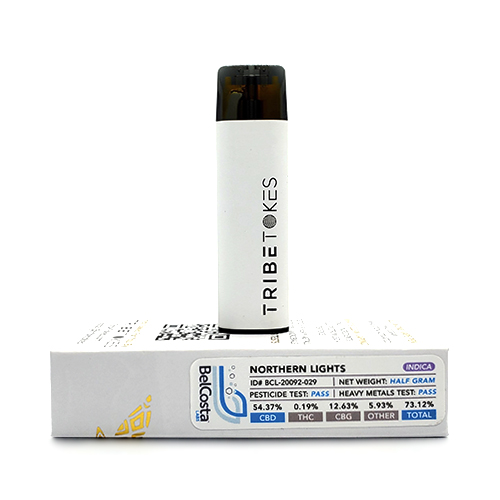

Northern Lights (Indica)

This is the only indica strain that I was sent and it works absolute wonders towards getting me a good night’s sleep. I feel super relaxed when I vape on this strain, and if I vape it right before I go to bed, it puts me right to sleep. This is the CBD strain I needed right here.

This is one of the more cannabinoid-rich strains that I was sent, as it contains 54.37% CBD, 12.63% CBG, 0.19% THC, and 5.93% other cannabinoids for a total cannabinoid content of 73.12%. This strain is packed with the terpenes terpinolene, caryophyllene, limonene, myrcene, and pinene. Northern Lights CBD has a sweet taste on the inhale, with very earthy tones that pop up on the exhale

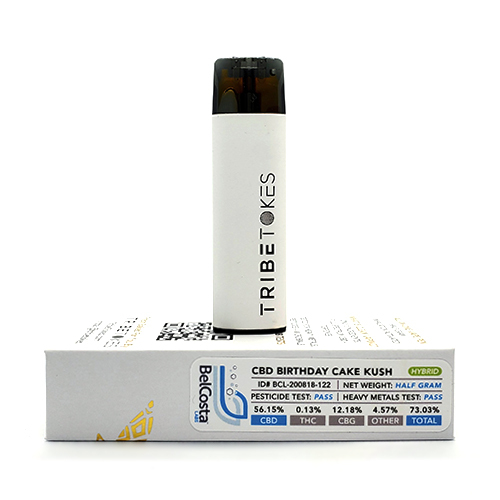

Birthday Cake Kush (Hybrid)

This is an indica-dominant hybrid with rest-promoting effects that are less powerful than Northern Lights, but still noticeable. I found it great for relaxing at the end of the day and just kicking back. This is another cannabinoid-rich strain as it contains 56.15% CBD, 12.18% CBG, 0.13% THC, and 4.57% other cannabinoids for a total cannabinoid content of 73.03%.

The terpene profile for this strain includes limonene, caryophyllene, myrcene, and linalool. Personally, I think that this is by far the best-tasting strain of the bunch. It has a sweet, vanilla-esque flavor on the inhale that you taste even more strongly on the exhale. It’s not too earthy at all and very tasty. It’s a super smooth vape, too.

Other TribeTokes CBD products

TribeTokes carries a huge range of CBD products and they’re all as high-quality as their disposable CBD vape pens. Below is a list of all of the different CBD products that TribeTokes carries:

- CBD disposable vape pens

- CBD vape cartridges

- CBD creams

- CBD tinctures

- CBD gummies

- CBD pain creams

- CBD skin creams

- CBD masks

- CBD serums

- CBD gum

Verdict

Most of the CBD products that I use are flavored so I wasn’t sure how much I would like naturally flavored CBD vapes but I have to say that TribeTokes disposable CBD vapes pleasantly surprised me. The different strains and their varying terpene composition are really tasty and smooth to vape on.

I also like that their lab test results are easily accessible and show that their full spectrum CBD distillate is also rich in other cannabinoids — not just CBD. The fact that their disposable CBD vape pens contain only the above mentioned ingredients (full spectrum CBD distillate and terpenes) is amazing.

All this to say, if you’re after the purest CBD vaping experience that you can get, TribeTokes disposable CBD vape pens are the way to go.

SAVE 15%

CODE: VERSED

Add comment