This is a sponsored press release that has been written and provided by MAXUS.

The views and opinions in this article are those of the authors and do not necessarily reflect the views and opinions of Versed Vaper.

MAXUS, a US-based vaping brand with all products built in the United States and filled with premium US-made e-liquids, has now officially unveiled its newest product—the MAXUS STAR 50K. This new disposable vape combines advanced technology, redefined craftsmanship, and flavors tailored to the preferences of the US consumers.

State-Inspired Flavors with US-Made E-Liquid

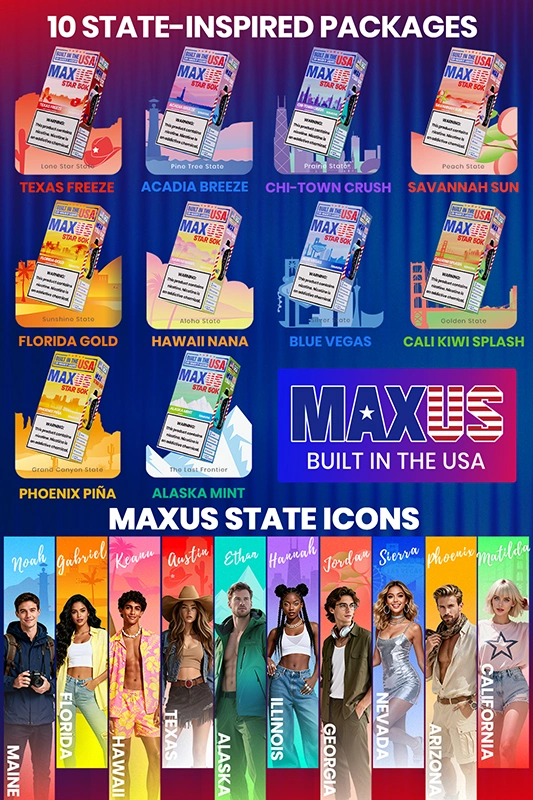

MAXUS STAR 50K debuts with 10 unique state-inspired flavors, each crafted with US-made e-Liquid to capture the essence of US regions. From flavor names to e-liquid taste profiles and even product design elements, every detail reflects the distinct character of the states they represent.

Backed by an R&D team with more than a decade of experience in the vaping industry, MAXUS ensures that these flavors not only align with American consumer preferences but also showcase the authenticity of locally crafted e-liquids. By pairing US-made e-liquids with themes rooted in US geography and lifestyle, MAXUS delivers more than just a vape—it offers users a sense of place and identity with every puff.

Alongside the launch of the 10 state-inspired flavors, MAXUS has also partnered with 10 distinctive and charismatic STATE ICONS to bring these flavors to life. Each icon embodies the spirit of their state—through personality, lifestyle, and cultural pride—serving as the voice of the flavor they represent and showcasing the diversity and individuality of American culture.

3D Curved Screen, Shine Like the Stars

The STAR 50K introduces a 3D curved display that provides real-time information on battery life, e-liquid level, and power mode. The display is enhanced with twinkling star-shaped lighting effects, creating an immersive visual experience visible from every angle.

Dual Mesh, Dual Modes

MAXUS STAR 50K applies Dual Mesh coil technology with two distinct vaping modes:

Normal Mode – Up to 50,000 puffs of long-lasting pleasure with two meshes heating alternately at 25W, delivering smooth, consistent, and layered flavors throughout the vaping session.

Turbo Mode – Up to 25,000 puffs of intense satisfaction with both meshes heating simultaneously at 35W, unleashing a rush of dense vapor and delivering richer, more intense flavors in every puff.

Normal Mode reveals a starry glow, while Turbo Mode amplifies the effect—more stars illuminate the screen, creating a dazzling, high-energy display that mirrors the intensity of each puff.

Switching between the two modes is effortless—users simply slide the control at the bottom of the device to adjust airflow and power simultaneously, enjoying a tighter draw in Normal Mode or a looser draw in Turbo Mode for a fully customized vaping experience.

850mAh Battery for Longer Enjoyment

Equipped with a rechargeable 850mAh battery, the STAR 50K provides consistent performance from the first puff to the last. USB-C charging capability ensures fast and convenient recharging, minimizing downtime and maximizing usage.

Make America Vape Great Again

By integrating state-inspired flavor themes, authentic US-made e-liquids, and expert American craftsmanship, MAXUS has created more than just a product—it is driving a transformation of the entire US vaping industry. Against the backdrop of manufacturing reshoring and the revival of American-made excellence, the launch of the MAXUS STAR 50K marks not only a paradigm shift in design and technology but also a new direction for the US vaping sector.

It demonstrates that American manufacturing has the capability to lead the world in innovation, craftsmanship, and creativity. It echoes the demand of American consumers for authenticity, locality, and uncompromising quality. And most importantly, it signifies that the future of vaping will be defined not by dependence on overseas production, but by standards born and perfected in the United States.

With its call to MAKE AMERICA VAPE GREAT AGAIN, MAXUS envisions a future where American-made vapes lead the global industry, reshape the landscape of the market, and secure America’s place at the very center of vaping excellence.

The MAXUS STAR 50K is now available across the US. For more details, please visit https://www.maxusvape.com

Add comment