Get the most out of your cartridges with these proven 510 batteries

Any cartridge offering good effects and high-quality material needs one key thing — a good source of power.

Without a reliable ‘push’, you won’t be getting the best out of your cartridge or wax atomizer.

A good 510 thread battery will be powerful enough to efficiently vaporize the material in your cartridge, and consistent and reliable enough to provide that power for many cartridges to come.

However, not all 510 thread batteries are created equal. To help you choose the 510 vape battery that is right for your specific needs, we’ve gone ahead and done the legwork and have put together this list.

These 510 batteries have been selected based on their price, quality, features, and battery life so you can be sure that you’re getting a battery that is both powerful and reliable.

OUR TOP PICKS

Why Trust Us

All of our buyer's guides and reviews are based on market research, expert input, and practical experience with the products we include. This way, we offer genuine, accurate guides to help you find the best picks.

How we test

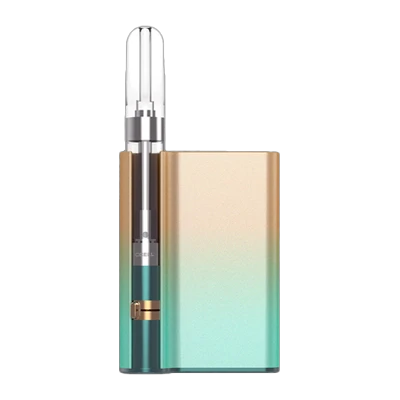

Best Overall

5.0

Exemplary

- Dimensions: 90mm x 42mm x 24mm

- Cartridge Compatibility: Most 510 cartridges

- Max. Cartridge Diameter: 11.5mm

- Firing Method: Draw activated

- Preheat Functionality: Yes

- Adjustable Airflow: No

- Adjustable Output: Yes (3 levels)

- Output Range: 2.8V, 3.2V, 3.6V

- Battery Capacity: 760mAh

- Charging Type: 2A Type-C

PROS

- Premium design

- Allows for complete discretion; concealed cartridge design

- Three different voltage settings + preheat mode

- Extended air path effectively cools down vapor for smoother draws

- Excellent battery life & quick charging

CONS

- Bulky

- More expensive than other 510 batteries

Why We Picked It

DaVinci is a brand best known for its top-quality dry herb vaporizers. Now DaVinci has applied its technology and vaporizer know-how to a 510 battery, and the result is the ARTIQ.

The ARTIQ completely conceals your cartridge inside the device for maximum discretion. This concealed design also maximizes the life and quality of your cartridge by preventing any degradation from light.

The three different voltage settings (2.8V, 3.2V, 3.6V) and inclusion of a preheat mode (1.8V) make the ARTIQ highly versatile for different use cases. Go low for lighter vapor and more flavor, high for denser and heavier draws, or medium for the best of both worlds.

What really sets the ARTIQ apart from the competition is its extended airpath, which cools hot vapor back down to room temperature. The vapor is smooth and tolerable, even when vaping at the highest voltage setting, significantly reducing irritation and coughing.

Last but certainly not least, the 760mAh battery lasts for about 500 draws. This means days or possibly even weeks of use, depending on how much you vape. With Type-C charging, the ARTIQ only takes 1 hour to fully recharge.

The smoothness of the draw, versatile temperature settings, discreet design, and long battery life make the ARTIQ our top choice for a 510 battery. It’s a little pricey at $60, but if you can afford it, it’s worth the money.

SAVE 15%

CODE: VERSEDVAPER

Approx. Price: $60 USD

Runner-Up, Best Overall

4.5

Outstanding

- Dimensions: 71mm x 35mm x 16mm

- Cartridge Compatibility: Most top & bottom airflow 510 cartridges

- Max. Cartridge Diameter: 11.5mm

- Firing Method: Button & draw activated

- Preheat Functionality: No

- Adjustable Airflow: No

- Adjustable Output: Yes (5 levels)

- Output Range: 2.43V to 3.84V

- Battery Capacity: 660mAh

- Charging Type: Type-C

PROS

- Portable size and comfortable to hold

- Compatible with most 510 cartridges (<11.5mm diameter)

- Magnetic cartridge connection is convenient and works great

- 5 voltage output levels

- Battery lasts for a few hundred puffs on a single charge

CONS

- No dedicated preheat functionality

- Button combinations can be confusing at first

- Very expensive

Why We Picked It

Machined from a solid block of aluminum, the PCKT Two stands out from the competition with its excellent build quality and high-end design. It’s 71mm tall, 35mm wide, and 16mm thick, so it’s both portable and comfortable to hold, while providing premium performance too.

The PCKT Two fits any 510 threaded cartridge with a diameter of less than 12mm, which means that it’s compatible with 99% of cartridges on the market. Cartridges attach magnetically to the device, and the PCKT Two includes two 510 magnetic adapters (one tall and one short) in the package.

There are five voltage settings which are indicated by the color of the LED ring: 2.43V, 2.73V, 3.09V, 3.54V, and 3.84V. To change the voltage, simply press the power button twice, then click the power button to cycle through the five output settings. The power button can also be clicked quickly to display your battery life.

The PCKT Two features both draw and button activated firing, so you can vape it however you prefer. Battery life is also excellent, as it packs a 660mAh battery which will last for a few hundred puffs on a single charge. The PCKT Two recharges quickly through Type-C Charging.

As an added bonus feature, the PCKT Two features adjustable haptic feedback and will vibrate upon draw activation. This lets you know that it’s working right away, so you won’t have to wonder if you’re actually getting a draw or not.

With its five voltage output settings and draw or button activated firing, the PCKT Two allows you to vape how you want. This, combined with its build quality and performance, makes it our top pick for a 510 thread battery.

Read our full review on the PCKT Two.

SAVE 15%

CODE: VERSED

Approx. Price: $80 USD

Best Battery Life

4.5

Outstanding

- Dimensions: 60mm x 36mm x 15mm

- Cartridge Compatibility: Most top & bottom airflow 510 cartridges

- Max. Cartridge Diameter: 12mm

- Firing Method: Button activated

- Preheat Functionality: Yes

- Adjustable Airflow: No

- Adjustable Output: Yes (4 levels)

- Output Range: 2.6V to 3.8V

- Battery Capacity: 650mAh

- Charging Type: Type-C

PROS

- Side viewing window to check cartridge level

- Preheat functionality for dense vapor from the first puff

- Compatible with most 510 cartridges (<12mm diameter)

- Four voltage output levels

- Includes four magnetic adapters

- Excellent battery life

CONS

- Cartridges wiggle a bit when seated

- No draw activated firing

Why We Picked It

The TribeTokes TribeMini is a small 510 vape battery that is universally compatible with standard vape cartridges. The TribeMini conceals your cartridge within the device and features a slim viewing window which allows you to check on your cartridge without removing it.

This setup allows the TribeMINI to remain portable for when you’re on-the-go, makes it easier to keep tabs on your cartridge level, and protects the cartridge from breaking in your pocket. It’s a neat and convenient design.

The TribeMINI features a unique display panel which allows you to set the voltage to one of four levels: 2.6V, 3.0V, 3.4V, or 3.8V . To change the voltage level, simply press the power button three times and the display panel will highlight your selected voltage.

The TribeMINI also features a 15 second preheat mode which can be activated by pressing the power button twice. This preheat mode heats up your cartridge at a low voltage in order to ‘get it started’. This saves you from struggling to get your first puff and allows for full and dense pulls right from the get-go.

The 650mAh battery that is built-into the TribeMINI will provide long lasting battery life, anywhere from days to weeks of use depending on the voltage and how often you vape. In any usage scenario, the battery life is solid.

For the reasons listed above and more, the TribeTokes TribeMINI makes our list as one of the best 510 vape batteries in 2025.

SAVE 15%

CODE: VERSED

Approx. Price: $45 USD

Best Portability

4.5

Outstanding

- Dimensions: 57.5mm x 41.9mm x 13.7mm

- Cartridge Compatibility: Most top & bottom airflow 510 cartridges

- Max. Cartridge Diameter: 11mm

- Firing Method: Draw activated

- Preheat Functionality: Yes

- Adjustable Airflow: Yes

- Adjustable Output: Yes (3 levels)

- Output Range: 2.8V to 3.6V

- Battery Capacity: 500mAh

- Charging Type: Type-C

PROS

- Very small and extremely thin

- High end and premium design

- Airflow adjustment slider is a great feature

- Preheat mode is great for thicker oils

- 3-Bar Battery Status LED

CONS

- Doesn't come with a "tall" magnetic adapter

- Can't accommodate larger diameter carts

Why We Picked It

The CCELL Palm Pro is one of the slimmest and lightest 510 batteries on the market. It’s made primarily from aluminum alloy and has a clean, minimalist aesthetic that communicates right away that it’s a premium and high-end device. But don’t let the slim body fool you; it packs more power and features than you would think from just looking at it.

The CCELL Palm Pro is compatible with all 510 threaded cartridges, which easily attach via the included 510 thread magnetic adapter. It features three voltage output settings, as well as adjustable airflow. It also features a 10 second preheat mode which is useful when you’re using thicker oils as it saves you from getting it started yourself.

Just below where the cartridge sits is an airflow adjustment switch. You can use this to open or close the airflow for a tighter or looser draw, depending on your preference. This airflow slot itself is a slim slit and there’s a lot of variety in how you can set the draw.

On the top of the Palm Pro there is a button which is used to control the device. You can change the voltage output level by pressing and holding the button. The three voltage output levels are 2.8V, 3.2V, and 3.6V. The lower voltage outputs are better for flavor, while the higher output setting provides maximum vapor and is perfect for thicker oils or distillates.

The Palm Pro is easy to use, but still allows you to tailor your experience just by adjusting the voltage and airflow. Plus, it’s so slim that you can easily take it anywhere. All in all, the Palm Pro is a great choice for a 510 battery.

Read our full review on the CCELL Palm Pro.

SAVE 20%

CODE: VERSED

Approx. Price: $35 USD

Best for Beginners

4.0

Excellent

- Dimensions: 44.5mm x 41.5mm x 20mm

- Cartridge Compatibility: All 510 thread cartridges

- Max. Cartridge Diameter: 11mm

- Firing Method: Button-activated

- Preheat Functionality: Yes

- Adjustable Airflow: No

- Adjustable Output: Yes (3 levels)

- Output Range: 3.2V, 3.6V, 4.2V

- Battery Capacity: 350mAh

- Charging Type: Micro-USB (0.5A)

PROS

- Simple and beginner friendly

- Open cartridge area allows you to easily track your remaining material

- Three voltage settings each offer a distinct and different experience

- 10s preheat mode is great to have for starting thicker materials

- Great value; affordably priced at $20 USD

CONS

- Heavy for its compact size

- No real-time battery indicator

- Slow charging; micro-USB @ 0.5A

Why We Picked It

If you’re new to vaping and want something compact, affordable, and user-friendly, the Lookah Snail 2.0 is the best 510 battery to start with. It checks every box for beginner needs—ease of use, durability, and performance—all wrapped in a fun, snail-inspired design that fits in the palm of your hand. The open cartridge slot also lets you easily keep track of concentrate levels–a plus for beginners.

The Snail 2.0 is ultra-portable at just 52g and under 45mm tall, yet it’s built tough with a zinc alloy body that resists scratches and wear. The button is responsive and intuitively placed, and ribbed areas around the front and back provide some much-needed grip.

Using it is as simple as screwing on your cartridge, turning it on, preheating, and puffing. Three voltage settings (3.2V, 3.6V, 4.2V) let you customize your session, and the 10-second preheat mode helps warm up even thicker concentrates.

While it lacks a real-time battery indicator and still uses micro-USB charging, the 350mAh battery holds enough charge for casual use.

With its comfortable form, affordable price point, and dependable performance, the Lookah Snail 2.0 is an ideal pick if you’re just getting started with 510 batteries.

Read our full review on the Lookah Snail 2.0.

SAVE 20%

CODE: VERSED

Approx. Price: $20 USD

What is a 510 Thread Battery

A 510 thread battery is a generic term for batteries with a certain connector style. The ‘510 thread’ originates from when vaping was in its infancy, and only ‘eGo’ style pens were available.

These ‘screw-on’ style batteries had a 0.5mm ten-thread aperture. While eGo batteries are a little dated, the connector has remained the same; hence the name ‘510 thread battery’.

This type of battery is favored by users of THC oil and CBD oil cartridges. You might occasionally hear people refer to a 510 thread vape. In this case, they are talking about the entire device, not just the battery.

While batteries for cartridges have advanced leaps and bounds, and come in various shapes, types, and sizes, the aperture (or 510 thread) is still considered the most common ‘universal’ fitting for the overwhelming majority of cartridges and tanks. Most cartridges still feature the 510 thread connection, which means that they are usually compatible with a 510 thread battery.

510 Thread Batteries VS Box Mods/Vape Mods

You might be wondering if you need a 510 thread battery at all. Why not just use your cartridge with a box mod or vape mod that you would use for other vape tanks?

The answer comes down to airflow. Most ‘regular’ box mods/vape mods that are meant for vape tanks do not allow airflow through the 510 thread connector. This makes them impossible to use with most 510 cartridges, which pull air through the base of their 510 connector.

510 thread batteries are specifically made to allow airflow through the base of 510 cartridges.

In addition to airflow, 510 thread batteries have their power outputs adjusted for the relatively low-power needs of cartridges. While many ‘regular’ vape mods can output 100-200W, you don’t need that type of power for a cartridge.

If you want to use a 510 thread cartridge, you’re going to need an appropriate 510 thread battery.

Types of 510 Thread Vapes

510 thread batteries have evolved greatly from the early days of eGo-style pens. You can consider 510 style pens as the ‘granddaddy’ of both sides of the vaping family (nicotine and cannabis oil).

As a result, the family has grown and evolved to feature a vast range of devices that all fit under the “510 thread” umbrella.

Here are the various types of 510 vape batteries that you can expect to see, along with some of their typical pros and cons.

However, keep in mind that you may see some cross-over between the different types of 510 thread batteries. For instance, some 510 thread mods also conceal the cartridge inside of them, and some pen-style batteries can be put on a keychain.

510 Thread Mods

Why use a 510 thread mod, like the ones on our list, instead of a pen-style 510 thread battery? One word: customizability.

You will likely find that the predetermined power settings of smaller devices aren’t sufficient for getting the best out of your CBD/THC oil; this is where 510 thread mods come in.

Good 510 thread mods will allow you to adjust the power output, often coming with 3-5 output levels. You can use the lower levels for flavor and mellow effects, while the higher output levels are great for when you want to get the most out of what your cart has to offer.

Granted, the higher power outputs will use a little more battery. However, 510 thread mods often have a larger capacity battery which more than make up for this.

Power isn’t the only leg-up that 510 thread mods have on the competition. Most 510 thread mods, like the ones on our list, will come with a preheat setting which will get the material in your cartridge ‘started’. This preheating means that you’ll get dense, full draws right from the first pull.

Many 510 thread mods use magnetic adapters which screw onto your cartridge. This makes it easy to insert or remove carts, while also ensuring that they make a secure connection.

If you have multiple cartridges with different strains, the magnetic adapters can be a game changer. Simply attach the adapters to each cart and you can swap between them in seconds.

PROS

- Power output can be adjusted to your liking

- Larger battery for extended use

- Often feature a preheat setting

- Most are compatible with all cartridges

- Magnetic connection makes swapping cartridges easy

- Built to last

CONS

- More complicated to use than other 510 batteries

Classic Pen Style 510 Thread Batteries

The clue is in the name. This type of threaded 510 battery was one of the earliest. It was also one of the simplest to use. Looking roughly pen-sized, this battery was considered a ‘puff and go’ device, requiring no action from the user other than to draw on it.

This would activate a pressure switch which would fire the atomizer. The name for this method of activation is ‘draw activated’.

PROS

- Thin and portable

- Easy to carry

- Very easy to use

- Quick to charge

- No possibility of pocket firing

CONS

- Limited functionality

- Limited battery life

- Fixed voltage and power

eGo Style 510 Thread Batteries

There’s a good chance that you’ve already seen eGo style threaded batteries. They’ve been around for years. You can consider these devices the ‘original 510 thread’.

These batteries are not too dissimilar from the classic pen type of battery.

There are a couple of key differences, however.

eGo style batteries nearly always feature a button on the device that is pressed to activate the cartridge. You’ll find an increased degree of functionality too; many eGo-style devices will have adjustable power.

PROS

- Thin and portable

- Easy to carry

- Very easy to use

- Quick to charge

- Often offers adjustable power output

CONS

- Limited life span

- Relatively short battery life

- Possibility of pocket firing

Concealed 510 Batteries

‘Concealed’ doesn’t refer to the ease with which you can tuck the device away.

What it means is that the atomizer or cartridge is hidden away within the battery’s body. Depending on the model you choose, you may find that it is either draw-activated or button-fired.

The concealed feature offers several advantages over other types of 510 vape batteries.

It has less prominence vertically. This makes it much easier to store in your pocket. Some people prefer the way it fits into your hand too.

Dropping your device can often spell disaster. Broken cartridges are not so much of an issue when they are concealed. The battery housing helps to stop breakages through accidental damage.

Because of their size, they often offer longer battery life too!

PROS

- Ergonomic

- Protects cartridge from breaking

- Good battery life

- Often offer adjustable voltage

CONS

- Not always compatible with non-standard cartridges

- Can be hard to clean

- May be heavier than pen and eGo style batteries

E-pipe 510 thread Batteries

If you want to go ‘back to the old school’, then E-pipe style batteries could be for you. While not as commonly seen as other types of 510 batteries, these provide all of the same functionality as more modern 510 vape batteries but are designed in such a way as to emulate smoking a pipe or ‘bowl’.

They look pretty classy and you’ll often find them in various colors and finishes. Some will feature a button on the upper surface of the ‘bowl’, whereas others are draw-activated.

The battery is usually substantial. For example, most will be around 900 mAh while standard eGo batteries are usually 250-650 mAh.

PROS

- Excellent battery life

- Gentlemanly good looks

- Works with most cartridges and tanks

CONS

- Awkward fit in pockets

- Easy to break

- Old-fashioned look isn't for everyone

Keychain 510 Batteries

Look no further than a keychain battery for the easiest and most discreet way to carry 510 thread battery. These little devices can be great for a toke on the go.

While small, they offer a decent amount of power relative to their size. You’ll tend to find that they fit most standard 510 cartridges, with some even have magnetic fittings to make swapping out easy.

Charging is quick and easy too. Most will feature a USB-C style port that will have it ready to go in no time.

So, why wouldn’t you use one? Well, all that compactness comes with a few downsides.

First, the battery capacity isn’t going to be anywhere near that of its larger siblings. Also, you’ll be forever losing or misplacing it (just like a standard set of keys).

PROS

- Compact and discreet

- Very portable

- Quick to charge

- Easy to use

CONS

- Easy to lose

- Short battery life

- No adjustable power

Features to look for in a 510 Thread Battery

Not all batteries are created equal, and there are features amongst them that will appeal to you more than others. Here’s what you need to know.

Size and Weight

Are you someone who will use your device ‘on the go’, or is it something you’ll be using strictly at home? While larger devices generally offer more options and battery life, this comes at the cost of portability.

Consider what size of device will suit the majority of your use.

Battery Life

Small and portable batteries are great, but this comes at a price.

Smaller batteries will run out sooner and require charging more often. You’ll also find that the lifespan degrades with repeated charging.

If you aren’t familiar, battery life is measured in a figure called mAh (milliamp hours). Generally, the larger the mAh capacity, the longer the battery will last.

Connection Type

While 510 battery connections are designed to be universal, there are other things to consider.

Many 510 thread vape batteries will come with magnetic adapters that allow you to quickly insert and remove cartridges. These magnetic adapters also make it easier if you have multiple cartridges that you want to use.

Although this isn’t a must-have feature, it’s certainly nice to have.

Button or Draw Activated

This is purely down to personal preference. Some users prefer to use a push button (useful for preheating). In contrast, others like the ease and simplicity of simply of just taking a draw on their device.

Some 510 batteries are only draw-activated, some are only button-activated, and some offer both. If you prefer one or the other, make sure to pick a battery that suits your vaping style.

Customization

If you are someone who likes to play around and find your ‘sweet spot’, look for the ability to change settings on your device.

This can include the ability to change your wattage output, haptic feedback, or adjustable airflow. Most 510 thread mods will allow you to change between 3-5 output settings so that you can use the one that suits you best in terms of warmth, vapor, and effects.

Many 510 thread mods also feature a preheat setting which comes in handy for getting thicker oils started.

What Can You Vape with 510 Threaded Batteries?

The good news is that because of their versatility, 510 thread batteries can be used with various oils and concentrates. You ideally need to look for two things to ensure it will work:

- The thread of both the atomizer and the battery must be 510

- The device can provide enough power to ensure optimal performance

Most 510 thread batteries are compatible with the vast majority of cartridges out there, as 99% of cartridges also use a 510 thread.

If both of the above boxes are ticked, you will be able to use:

Wax Atomizers

Wax atomizers will work well with 510 thread batteries. As long as you make sure your atomizer is 510 compatible, you should be good to go!

THC Oil Cartridges

510 THC oil cartridges are custom-made to work with a 510 battery. It was one of the earliest innovations to take advantage of this technology. Again, check for 510 compatibility.

CBD Oil Cartridges

As with THC oil cartridges, CBD cartridges use a universal 510 threading. This means that they can be fitted to any 510 thread battery.

What Are the Benefits of 510 Thread Batteries?

There’s plenty to love about 510 thread batteries. Still not sure? Here’s what you get:

Adjustability

With the evolution of thread batteries, you get plenty of options when it comes to customization. It isn’t unusual to see variable voltage, which puts you firmly in the driving seat regarding power and intensity.

Discretion and Concealment

Big box mods/vape mods don’t quite tick this box, but most 510 thread batteries are small, compact, and light, allowing you to keep your vaping on the ‘down low’.

There are 510 thread vape battery options that are very small and discreet. Small enough to fit in a pocket (or even on a set of keys).

Ease of Use

Due to the universal nature of 510 threaded batteries, using them couldn’t be easier. It’s simply a matter of screwing in your atomizer or cartridge (or attaching the magnetic adapter), and you are good to go!

Preheat Settings

Waiting for your oil to come up to temperature is no fun. Preheat settings work by applying a low voltage for 10-15 seconds to get your oil going.

Once the preheat is over, you can vape away at your leisure without having to struggle to get a draw.

Compatibility

You can consider a 510 thread battery a ‘universal’ fitting. The beauty of this is that regardless of where you go and what you do, you can be reasonably assured that you’ll be able to find compatible atomizers, tanks, and cartridges.

How to Use a 510 Thread Battery

As we’ve said, one of the great things about a 510 thread battery is its easy use.

Here are some simple steps to get you started:

- Screw your cartridge into your battery. If your device uses magnetic adapters, screw the adapter onto the cartridge and drop it into the device.

- If using a refillable cartridge, fill it with your material. How you do this will depend on the cartridge that you are using.

- Switch your device on. With ‘draw activated’ devices, this won’t be necessary. For those with buttons, you’ll normally find that pressing the power button three or five times will turn the device on.

- Many 510 thread batteries will let you adjust the power output to your liking. How this is done with each device varies, as do the power output levels. If it’s your first time using a device, our advice is to start at the lowest setting power output and work your way up until you find a level that feels comfortable.

- Take a draw on the device. If your battery is button activated, keep the button depressed while taking a hit. If using a draw-activated device, simply inhale on the cartridge to vape.

Tips for Using 510 Thread Batteries

While 510 thread batteries are pretty straightforward, there are a few tips and tricks that you should know to make the experience better.

1. Let your Wicks Soak

Dry or burnt hits are never pleasant. It’s a one-way ticket to ‘sore throat town’.

We suggest waiting a few minutes between filling your cartridge and vaping. By allowing your oil to soak into the wicks, you’ll ensure that they are properly saturated and therefore less likely to burn.

2. Lock Your Device When Not In Use

There’s nothing worse than getting that warm feeling in your pocket, only to find your cartridge is toast and the material inside is ruined. You would be amazed at how easy it is to ‘pocket fire’ your device.

If you are not using your 510 device (especially if you are putting it in your pocket), we’d advise ‘locking’ it or turning it off.

3. Fully charge your battery

Lithium-Ion batteries can be quite fickle and need a lot of love to stay in good shape. When charging your battery, ensure that it is fully charged each time before use.

Generally, the more you charge batteries, the shorter their life span becomes. Use your battery to nearly empty and then charge it all the way up to give it a longer, more reliable lifespan.

4. Go Little and Often, Not Long and Hard

While we all love taking a big rip on our device, it is better to sip than to gulp. Overdoing it with long hard pulls increases the chances of the wicks drying out and subsequently burning.

Since many 510 thread batteries can output relatively high amounts of power, it’s easy to overdo it. Take shorter hits if you prefer to use a higher voltage-output.

5. Use Good Quality Chargers

Ever noticed how your phone isn’t holding a charge as well as it used to? The amp rating of your charger can also affect how long your 510 thread vape lasts.

Where possible, try and use the charger and cable that comes with the device. If this isn’t possible, use a charging block that charges at the listed charging speed for your 510 battery.

Final Thoughts

The whole purpose of 510 thread batteries is that they are easy to carry, a breeze to use, and give you all the power you’ll need to have an enjoyable experience.

There’s plenty to choose from, and a lot of your decision will boil down to personal preference.

Let us help you

Have a question or a comment? Need help? Even if you just want to share your love for vaping. Send us an email! We would love to hear from you!