UWELL Caliburn G4

4.5

Outstanding

UWELL Caliburn G4 Mini

4.0

Excellent

PROS

- Very nice design on the G4

- G4 Mini is lightweight, compact, and easy to use; great for beginners

- Transparent pods with e-juice window make it easy to monitor e-juice levels

- Both devices feature adjustable airflow, as well as flipping the pod, to fine-tune the draw

- Upgraded GPP pods provide great flavor and longevity

- Compatible with all GPP (G3) pods, including older ones

- Full-color display on the G4 with detailed vape info and settings

- Three UI themes on the G4

- G4 offers adjustable wattage up to 35W

- G4 features fast 2A Type-C charging; full charge in ~40 minutes

CONS

- No clear explanation from UWELL on the actual effect of the vape modes (storm, wave)

- G4’s 0.85” display is small and may be hard to read for some users

- G4 Mini only includes a single 0.6Ω pod; not ideal for MTL users

- G4 Mini’s LED battery indicator isn’t very precise; a 4-color LED would have been better

The bottom line

The difference between the G4 and G4 Mini is pretty clear-cut; the G4 is the more advanced and feature-packed device, and as such offers more adjustability at the cost of being slightly larger and heavier. The G4 Mini is simpler, smaller, and lighter, making it more ideal for vapers who want a device that they can just fill and vape.

I’m partial to the G4, even with its chunkier frame. It looks really good, and having the display to show battery life percentage and adjust the wattage is nice to have. It also lasts for a little longer thanks to the 1300mAh battery, so it has a leg up over the G4 Mini.

Performance from both devices is identical, with both delivering good flavor and longevity from the new GPP pods. The 0.6Ω pod is going to be the one for RDL vapers, while the 0.9Ω pod is the choice for MTL vapers. Unfortunately, the G4 Mini only comes with a single 0.6Ω pod. It can be used for MTL vaping, but it’s not as tight of a draw or as good of an experience as the 0.9Ω pod if MTL vaping is what you’re after.

If price is a concern, I’m seeing the G4 Mini for way cheaper than the G4. The G4 is selling for around $25, while the G4 Mini is around $10, which is very cheap. If you don’t care about all the bells and whistles, you really can’t go wrong with the G4 Mini for ten bucks.

SAVE 12%

CODE: VERSED

Approx. Price: $25 USD

Approx. Price: $10 USD

Product Overview

The newest additions to UWELL’s Caliburn series of devices are here: the Caliburn G4 and G4 Mini.

Like previous devices in the series, these are tall and slim pod vapes, and the Caliburn G4 in particular brings some small upgrades over the Caliburn G3 and even the Caliburn G3 Pro. It features adjustable wattage up to 35W, three different themes, two different output modes, and a pretty nifty adjustable airflow setup.

On the other hand, the G4 Mini is a simple pod device. It can output a maximum of 35W, however, the wattage is not adjustable. The G4 Mini does feature adjustable airflow, though.

Both devices come with upgraded Caliburn GPP cartridges, but are compatible with older GPP pods from the Caliburn G3, G3 Pro, and G3 Pro KOKO.

It’s always exciting to review a new Caliburn device. Nearly all of UWELL’s previous Caliburn devices have been hits, so I expect even better performance from these fourth-generation devices.

Caliburn G4

- 1 x Caliburn G4 Device

- 1 x Caliburn GPP Pod Cartridge (0.6ohm)

- 1 x Caliburn GPP Pod Cartridge (0.9ohm)

- 1 x User Manual

- 1 x Type-C Cable

Caliburn G4 Mini

- 1 x Caliburn G4 Mini Device

- 1 x Caliburn GPP Pod Cartridge (0.6ohm)

- 1 x User Manual

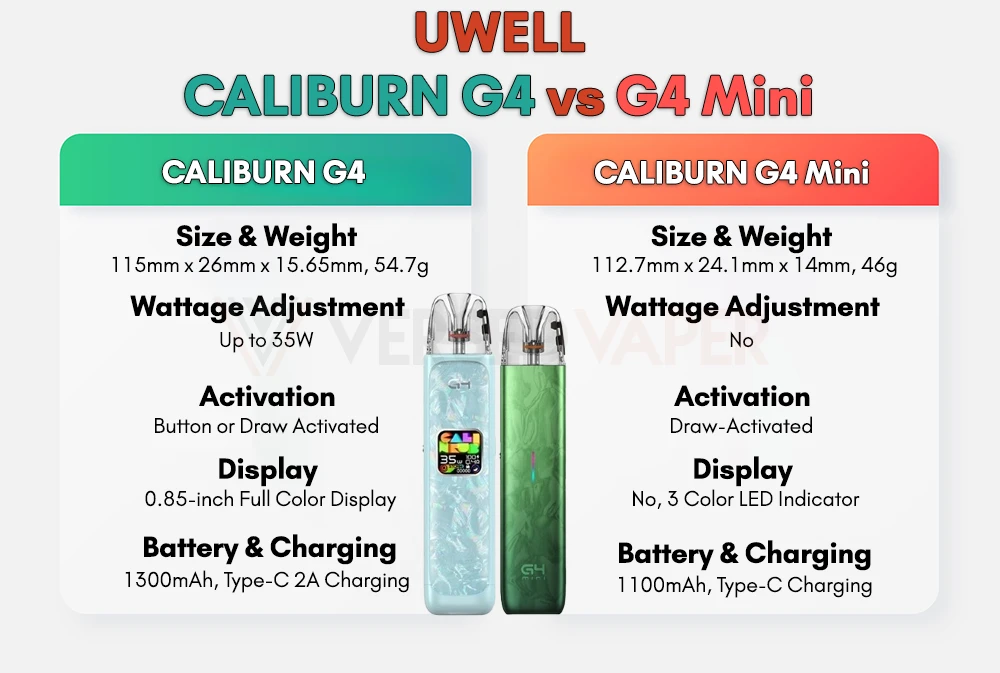

Caliburn G4

- Size: 115mm x 26mm x 15.65mm

- Weight: ~54.7g

- Compatible with all GPP (G3) Cartridges

- Pod Capacity: 3ml (0.4Ω INT/FDA), 2ml (CRC/TPD)

- Button/Draw activated

- RDL to tight MTL draw

- Battery Capacity: 1300mAh

- Wattage Range: 5-35W

- Adjustable Wattage

- Adjustable Airflow

- 0.85” Full-Color Display

- Charging: 2A Type-C

Caliburn G4 Mini

- Size: 112.7mm x 24.1mm x 14mm

- Weight: ~46g

- Compatible with all GPP (G3) Cartridges

- Pod Capacity: 3ml (0.4Ω INT/FDA), 2ml (CRC/TPD)

- Draw activated

- RDL to tight MTL draw

- Battery Capacity: 1100mAh

- Wattage Output: 35W Maximum

- Adjustable Airflow

Design & Build Quality

Every new Caliburn device comes with a radical new design, and the Caliburn G4 is no exception. Other than the fact that it’s tall and slim, it looks drastically different from the Caliburn G3, G3 Pro, and even the G4 Mini.

The G4 follows the trend of pod vapes becoming larger and heavier with every iteration. It’s slightly thicker and wider than the G3 at 115mm tall, 26mm wide, and 15.65mm thick, and also a bit heavier at around 55g. Still slim and portable, just less so than the Caliburn G3.

I’m really liking the new look and designs for the G4. There are four swirly, metal fronts, and four fronts that look like a chunk of opal is sitting on the device. They all look very good, but I’m partial to the opal designs. The way the light catches it and creates little rainbows of color is just so cool.

Since the G4 is a little chunkier than the Caliburn G3, I find that it feels better in the hand. It fits more naturally, and the curved sides keep it comfortable to grip and hold. The menu/power/firing button is well-placed for thumb-firing, so this should please all those who like button-activated vaping.

There’s a useful e-juice viewing cutout on the back of the G4. It works well thanks to the completely clear pods, and it’s easy to see how much e-juice is left in the pod at a glance.

The display on the G4 is not as large as the one on the G3 Pro, but it’s full color and displays a ton of info and options. I’ll get into these in the Features section of this review.

Let’s go over the G4 Mini real quick, and it will be quick because it’s a very simple device. The size and shape are nearly identical to the G3, just a little taller due to the 3ml pods. Weights are also basically identical at 46g. The G4 Mini actually reminds me a lot of the Uwell Caliburn A2 and A3S; simple with no display, just an LED indicator for information.

Like the G4, the Caliburn G4 Mini has an e-juice viewing window on the back and uses the same clear, upgraded GPP pods. There’s an airflow adjustment slider on the side of the G4 Mini, but that’s about it for adjustability.

Features

The Caliburn G4 is the most advanced and feature-packed Caliburn device yet, even beating out the very advanced G3 Pro Koko. The display is quite small at just 0.85 inches, though, which is a letdown.

The display is full-color and shows battery life percentage, coil resistance, wattage output, a puff counter, puff time, lock status, and mode. That last one is new to the Caliburn series, and the Caliburn G4 is the first Caliburn device to come with two different mode settings: Storm mode and Waves mode.

There’s no concrete description of what these modes actually do, though. From UWELL’s website, it looks like Storm mode is a boost mode, and Waves mode is normal mode. I don’t really notice a difference between the two modes myself. Maybe a slightly stronger draw in Storm mode, but that could just be my imagination.

The three different themes on the G4 are cool, with the first two being colorful and animated, and the last one being a black and white theme with no animation.

The menu, which can be accessed by pressing the button four times, provides access to change the modes, change between the themes, adjust the display brightness (day for brighter, night for dimmer), and reset the puff counter.

The G4 can fire at up to 35W and features fully adjustable wattage. The wattage can be set by pressing the button three times, and then pressing or holding the button to adjust the wattage.

The G4 can be button-fired by pressing and holding the button. To prevent pocket firing, it can be locked by pressing the button twice. However, this still allows you to change the wattage by pressing the button three times.

As with the design, the G4 Mini doesn’t bring much to the table. There’s no display or buttons, so no menu options, modes, or adjustable wattage. It’s draw-activated only, and automatically adjusts the wattage based on the pod that you’re using. The LED on the front of the G4 Mini lights up and changes colors as you vape, but that’s really the extent of the features.

Caliburn G4 Button Combinations

- Power ON or OFF: Press the side button five times.

- Lock/unlock button activated firing: Press the side button two times.

- Change wattage: Press the side button three times.

- Access the menu (change modes, themes, screen brightness): Press the side button four times.

Pods

The design upgrades, color screen, and menu options on the Caliburn G4 are cool and all, but the pods are what really matter. For the G4, Uwell has upgraded the GPP pods that come with the G3, G3 Pro, and G3 Pro Koko to make them even better. However, the G4 and G4 Mini are compatible with all GPP pods.

The pods that come with the G4 and G4 Mini are side-filled pods, and the fill port can be accessed while the pod is still inserted in the battery. They’re also transparent, making it easy to see how much e-juice is left inside of them.

The G4 comes with a 0.6Ω pod and a 0.9Ω pod. The G4 Mini comes with a single 0.6Ω pod.

These pods have a 3ml capacity, which means a little less frequency of fillings compared to a 2ml pod. It’s always nice to vape more and fill less!

These pods are powered by UWELL’s PRO-FOCS 4.0 tech, which they say increases cartridge lifespan and flavor by up to 35%. These pods also have another feature, which is that they can be rotated to change the airflow.

On the bottom of the pod, you’ll see two holes which are labeled as S (small) and B (big). Whichever hole you insert on the same side as the airflow control slider will affect the airflow: a tighter draw with the small hole, and more airflow with the big hole.

The combination of how you insert the pod and how you adjust the airflow slider allows for more airflow adjustment than either one would allow alone, which is often the case with pod vapes.

Battery Life & Charging

The Caliburn G4 has received an upgrade in the battery department compared to its predecessors. It comes with a built-in 1300mAh battery, which is a higher capacity than the G3 Pro (1000mA), G3 Pro KOKO (1250mAh), and G3 (900mAh).

The Caliburn G4 has an on-screen battery percentage display, while the G4 Mini only has a three-color LED indicator. The colors and corresponding battery life for the G4 Mini are:

- Green: Above 60%

- Blue: 30-60%

- Red: Below 30%

Each LED color has a fairly wide range of battery life, so it can be difficult to determine the actual battery level. For instance, the LED can be blue, but the battery life is at 35%, which isn’t ideal if you’re about to leave the house with it. An additional battery life level would be ideal, but for a simple device, it’s what you get.

Let’s talk about battery life, though. When exclusively using the 0.9Ω pod with the G4, I can vape two full pods (6ml of ejuice) per charge. However, if using the 0.6Ω pod, this drops to about one and a half pods of usage (~4.5ml). The G4 Mini has a slightly smaller battery than the G4 at 1100mAh, so I vaped slightly less e-juice per charge with that device, but only barely.

Charging the G4 doesn’t take too long. It recharges in 40 minutes thanks to the 2A Type-C charging, which is on par with the G3 Pro. For the battery being higher capacity, I’d say that’s pretty good! The G4 Mini does not have 2A charging, and takes slightly longer (an hour) to charge.

Performance

The G4 and G4 Mini look like two completely different devices, but in practice, they perform just the same with the pods. The G4 gives a bit more control over the vape because you can adjust the wattage output, but the flavor and airflow are identical between the two.

The 0.6Ω pod is for RDL vapers, but it can be used for MTL as well. It’s a good and flavorful vape, and while my taste buds can’t differentiate that much of a difference from the previous generation GPP pods, it’s certainly a good pod.

Flipping the pod makes a small difference to the draw, but it’s enough to make the RDL draw a bit looser or a bit tighter to fit your preference. The airflow control slider is the main way to adjust the airflow, but it’s nice to have the simple option of flipping the pod for some minor adjustment.

The 0.9Ω pod gives a cooler draw than the 0.6Ω pod, which is expected given that it fires at 15W vs the 25W of the 0.6Ω pod. It’s a bit less flavor-dense than the other pod, but much better for MTL vaping as it delivers a tighter draw. Again, flipping the pod can be used to change the draw a bit, but using the airflow slider is where you’ll get the most difference in the airflow.

I’ve been using NKD100 salts with these pods, and each one has been through 20ml of e-juice (which is a good baseline for pod longevity). Both pods are still performing well, with no noticeable changes to the flavor or performance.

UWELL Caliburn G4 vs G4 Mini

The G4 and G4 Mini share some similarities, but there are also some significant differences between them. To make the differences more easily understandable and comparable, we’ve created this easy reference chart for you below:

Verdict

The difference between the G4 and G4 Mini is pretty clear-cut; the G4 is the more advanced and feature-packed device, and as such offers more adjustability at the cost of being slightly larger and heavier. The G4 Mini is simpler, smaller, and lighter, making it more ideal for vapers who want a device that they can just fill and vape.

I’m partial to the G4, even with its chunkier frame. It looks really good, and having the display to show battery life percentage and adjust the wattage is nice to have. It also lasts for a little longer thanks to the 1300mAh battery, so it has a leg up over the G4 Mini.

Performance from both devices is identical, with both delivering good flavor and longevity from the new GPP pods. The 0.6Ω pod is going to be the one for RDL vapers, while the 0.9Ω pod is the choice for MTL vapers. Unfortunately, the G4 Mini only comes with a single 0.6Ω pod. It can be used for MTL vaping, but it’s not as tight of a draw or as good of an experience as the 0.9Ω pod if MTL vaping is what you’re after.

If price is a concern, I’m seeing the G4 Mini for way cheaper than the G4. The G4 is selling for around $25, while the G4 Mini is around $10, which is very cheap. If you don’t care about all the bells and whistles, you really can’t go wrong with the G4 Mini for ten bucks.

SAVE 12%

CODE: VERSED

Approx. Price: $25 USD

Approx. Price: $10 USD

Add comment