Artrix SK8

4.5

Outstanding

PROS

- Simple to use; just draw on the mouthpiece to vape

- Straightforward to fill

- Very small and slim

- Extremely light

- Feels solid and rigid; body does not bend or flex

- Great for discreet use

- 8.5W output feels great and is powerful enough to effectively vaporize all manners of concentrates

- Excellent flavor and vapor from the flat mesh ceramic heating core

- Vapor tastes clean and unadulterated

CONS

- Not refillable

- Small 220mAh battery

- One color battery LED indicator

The bottom line

When it comes to cannabis vapes, I look for something that delivers excellent vapor, good flavor and effects that really work. This is exactly what the Artrix SK8 does, all in a compact and ready-to-go form. Because of how convenient the SK8 is, and with everyone living such busy lives, I think that this type of device is the future of cannabis consumption; at least in terms of cannabis concentrates.

Now, it wouldn’t be fair to compare the SK8 to large desktop rigs as it’s simply not in the same category. However, it’s certainly way more powerful than I expected, especially considering that it can be tossed in a pocket and used without any complicated set up required. It’s not a desktop experience by any means but it’s powerful enough that it makes me think twice about setting up my desktop rigs.

I have a lot of positive things to say when it comes to Artrix SK8; it holds up to 2ml of material, has a viewing window that is easy to see, it’s rechargeable, and it delivers an excellent draw with each puff.

There are some cons to mention like the fact that it is not refillable and that the battery indicator is only one color, but this is a disposable device after all. If you want these sort of options then they can be had with other devices, but keep in mind that this will set you into a higher price point than the SK8.

For what it is, the Artrix SK8 is an excellent option for someone looking for a simple and easy to use device that holds a decent amount of material. I would absolutely recommend this device to anyone with a new disposable cannabis vape on their wish list.

Artrix is an ever-growing company whose focus remains on delivering affordable, high quality cannabis vapes and hardware. In the past, I’ve had the chance to try most of their devices, with my personal favorites being the Lilmon, Fitty and DabGo.

What sets Artrix apart from the competition is their knack for creating portable devices that deliver surprisingly powerful performance, considering their small size.

The Artrix SK8 is one of these devices. It features a 2ml tank capacity, which is quite large considering its portability and small size, and it can output 8.5W of power, ensuring a consistent draw every time.

As a single-use disposable device, the SK8 is designed for a one time fill. Be sure to fill it with the full 2ml of product to get the most out of it—once the tank is empty, it can’t be refilled, so you’ll want to make every drop count. Although not refillable, the SK8 is powered by a 220mAh rechargeable battery.

I’ve been using the SK8 for just about two weeks now and I’m ready to give you the full rundown on this tiny but powerful THC vape.

- Size: 84mm x 30mm x 10mm

- Weight: 21g

- Food Grade PCTG Tank

- Flat mesh ceramic heating core

- 2ml Capacity

- 1.1Ω Resistance

- 8.5W Output power

- 220mAh Rechargeable battery

- Type C charging

- Snap-in Tip

- Draw activated

- Recommend Use with: D9/D8/CBD/HHC/HTE/Live Resin

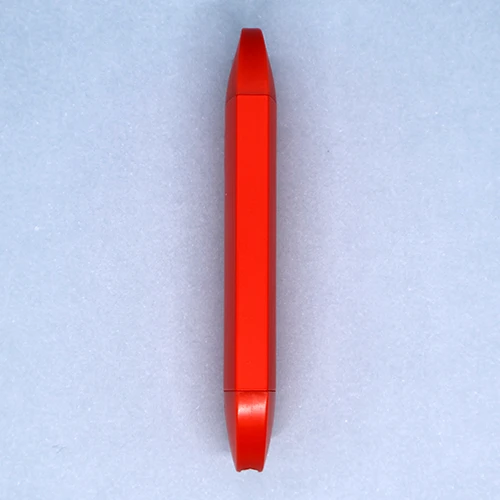

Design & Build Quality

The Artrix SK8 is a great portable option for those looking for an on-the-go device for cannabis vaping. At just 84mm tall, 30mm wide and 10mm thick, it is one of the smallest cannabis vapes I have used. This makes it a great option for those times when you want to travel light as it can be tossed in even the smallest of pockets or bags.

The Artrix SK8 is clearly named after a skateboard and does somewhat mimic a skateboard’s shape. However, I would personally liken it to more of a snowboard shape as it has no wheels (joking, of course). Whatever shape you want to say it is, it is extremely slim and slender, it’s comfortable to hold, and it feels great in the palm.

If you’re someone who likes to hang out at the party and not get noticed for their gardening activity, this is a great option. The SK8 looks like any other nicotine vape and it can easily pass as such. If you are looking to be even more discreet, the SK8 can be easily hidden in the palm of your hand.

No need to worry about the weight of carrying this little guy around. The SK8 only weighs 21g so it’s nearly undetectable when on my person. As these are so lightweight and easily misplaced in pockets, you will want to try to keep track of where you keep it; you do not want to wash a load of laundry and find this at the end of the cycle!

Over on Artrix’s website, they list just about every type of material used in each of their devices. However, I was not able to find anything about the material used for the body of the Artrix SK8. I am fairly certain that it is made with the same, if not similar, materials as used for the Artrix Sip. From what I can tell, it seems like the body is made of aluminum alloy, and the top and bottom connecting pieces are made of some type of plastic.

With that being said, the device is very sturdy and does not bend or flex at all. The shape of this device is a lot more pocket friendly than the Sip too, thanks to its shorter, stubbier design rather than the long and thin pen-like design of the Sip.

As an added touch, the SK8 comes finished with a soft-touch coating that makes the device feel really nice. It gives some added grip to the device as well. I did not notice any scratches or issues with the coating. However, I did notice a small paint-chip develop where the body meets the mouthpiece. This was truly a non-issue though as it did not affect the performance of the device at all.

To use the Artrix SK8 you will have to supply your own material. The tank holds up to 2ml of your favorite concentrate. When you have filled the device, you simply snap the mouthpiece into place. Once the mouthpiece is snapped into place it cannot be removed and will seal the device so make sure that you fill it up all the way to get the most out of it.

On the body of the device, just below where the mouthpiece and body come together, there is a viewing window that allows you to keep track of how much material you have left in the tank. The window is completely clear with no added tint, so it’s easy to see how much product you have left inside.

The bottom plastic piece of the device features a triangular LED that lights up with each draw. As with all of their other devices, this triangular LED is the Artrix logo. I really like that the LED is a logo but that it also serves a purpose. The only other marking on the SK8 is on the body, just below the viewing window, where there is a simple white Artrix logo.

The Type-C charging port is located on the bottom of the device to allow for recharging of the 220mAh battery.

My one issue with the design is, thanks to its symmetrical shape, there is a high chance that you accidentally pull this out of your pocket and try to take a draw on the charging end of the device. This has happened to me many times when I’ve mindlessly taken the SK8 out of my pocket and put it up to my mouth without looking at the device.

To prevent this from happening, I simply made a habit of making sure that the viewing window was at the top of the device when taking a draw. You’ll want to do the same if you get the SK8!

How to Use the Artrix SK8

When it comes to using any of Artrix’s devices, the procedure for filling is essentially the same. The key to this being mess free and straight forward is being prepared and having the right tools.

To fill the SK8 you’re going to want to get your favorite concentrate, a dispensing syringe (I prefer to get concentrates that are already in a syringe from my local dispensary) and a dispensing needle tip. Previously, I had used an 18g needle but it took forever to load the product into the device. This time, I opted for a 14g needle and the process was much quicker. If you don’t have syringes or needles, I was able to find some on Amazon for around $10.

When you have all of your supplies and are ready to fill, follow these simple steps to get going:

- Attach the needle tip to your syringe. If you’re using concentrates that come in an applicator (like we have available at cannabis stores here in Canada), you can simply screw the needle tip onto the applicator.

- Insert the needle tip into the center hole and fill the tank with your concentrates.

- Depending on the consistency of your concentrates, Artrix recommends waiting a set amount of time before snapping in the mouthpiece. If your material is thin, Artrix recommends waiting 90 seconds before snapping in the mouthpiece. For thicker materials, Artrix recommends waiting 180 seconds.

- Push and slide the mouthpiece down onto the top of the Sip until it snaps in and sits firmly in place and flush with the battery.

- Artrix recommends waiting four hours before using the device.

- After the recommended waiting period is up, simply draw on the mouthpiece to vape.

Performance

You don’t need to worry about whether or not the Artrix SK8 will be able to handle your cannabis concentrates. As I was sent two of these to test out, I was able to use two different consistencies. One being a less viscous, oil-like concentrate and the second being quite a bit thicker in the form of live resin. In both cases, the SK8 handled it beautifully. I didn’t have any issues with the device struggling to heat up the material and with each draw it reacted instantly.

With the SK8, there is no central post like you might find on other small concentrate vapes. Instead, there is simply a a flat mesh ceramic heating core inside of the food grade PCTG tank. Artrix says that this setup guarantees a clean vaping experience and, from what I’ve experienced, it’s the real deal. Flavor is top notch and does not taste adulterated at all by the device.

The SK8 delivers an extremely smooth and almost undetectable draw (it’s seriously dangerously smooth). As you are drawing on the device, the vapor is lukewarm and then once it hits the throat, you notice the hit right away. From here, the flavor of my concentrate just lingers on my tongue. This is certainly one of the most flavorful, portable cannabis vapes that I have used to date so it’s a shame that it can’t be refilled.

The battery is quite small on the Artrix SK8. At a mere 220mAh, the battery is much smaller than the one they used in the Artrix Sip (300mAh). However, because the SK8 doesn’t use much power, the battery should last most users a couple of days before needing a recharge. If you’re a heavy vaper and use this all day, you should still have no issue with getting through at least the day before needing to plug it in.

Verdict

When it comes to cannabis vapes, I look for something that delivers excellent vapor, good flavor and effects that really work. This is exactly what the Artrix SK8 does, all in a compact and ready-to-go form. Because of how convenient the SK8 is, and with everyone living such busy lives, I think that this type of device is the future of cannabis consumption; at least in terms of cannabis concentrates.

Now, it wouldn’t be fair to compare the SK8 to large desktop rigs as it’s simply not in the same category. However, it’s certainly way more powerful than I expected, especially considering that it can be tossed in a pocket and used without any complicated set up required. It’s not a desktop experience by any means but it’s powerful enough that it makes me think twice about setting up my desktop rigs.

I have a lot of positive things to say when it comes to Artrix SK8; it holds up to 2ml of material, has a viewing window that is easy to see, it’s rechargeable, and it delivers an excellent draw with each puff. There are some cons to mention like the fact that it is not refillable and that the battery indicator is only one color, but this is a disposable device after all. If you want these sort of options then they can be had with other devices, but keep in mind that this will set you into a higher price point than the SK8.

For what it is, the Artrix SK8 is an excellent option for someone looking for a simple and easy to use device that holds a decent amount of material. I would absolutely recommend this device to anyone with a new disposable cannabis vape on their wish list.

Add comment