Get massive flavor & clouds with these high-performing sub ohm tanks

No matter if you’re a beginner or an advanced expert, sub ohm tanks are a sure staple in any vapers collection. Because of their easy-to-use nature, sub ohm tanks are usually the first go-to vape tank for most beginner vapers, but more advanced vapers love them too for their great flavor and cloud production.

But with so many different and varying sub ohm tanks out there it can be hard to know if you’re getting a great vape tank or just throwing your money and ejuice down the drain.

With that in mind, we’ve chosen these sub ohm tanks based on their flavor, cloud production, airflow and tank capacity, to help you find the right pick for you.

OUR TOP PICKS

Why Trust Us

All of our buyer's guides and reviews are based on market research, expert input, and practical experience with the products we include. This way, we offer genuine, accurate guides to help you find the best picks.

How we test

5.0

Exemplary

- Airflow: Dual Wide-Slot, Adjustable Top Airflow

- Tank Capacity: 5.5ml

- Available Coils:

- PnP X 0.15Ω (60-80W)

- PnP X 0.20Ω (40-60W)

- PnP X 0.30Ω (32-40W)

- PnP X 0.45Ω (25-32W)

- PnP X 0.60Ω (18-23W)

- PnP X 0.80Ω (12-16W)

- PnP X 1.0Ω (10-13W)

PROS

- Great design

- Fully adjustable top airflow

- Long coil life (tested); rated for 100ml of ejuice

- Compatible with all PnP X coils (7 coils to choose from)

- No leaking

CONS

- Not backwards compatible with PnP coils

Why We Picked It

The UFORCE-X is VOOPOO’s flagship tank and it’s one of the best that we’ve ever tried. It takes their latest series of coils, their PnP X coils, and there are seven resistances available. This means that no matter what wattage you like vaping at, there’s a PnP X coil for you.

The UFORCE-X will hold 5.5ml of ejuice with the included bubble glass, and it’s a top airflow tank so the chances of that ejuice leaking out are slim. The two large and fully adjustable airflow slots allow for plenty of customization to the draw, so you can really dial in the perfect RDL or DL airflow.

One thing that really impressed us about the UFORCE-X is the longevity of the included coils. You can run 80ml+ of ejuice through these coils before the flavor starts to drop off, and even then it’s a barely noticeable difference. If you use ejuices that aren’t too heavy on the sweetener, you can easily vape 100ml+ of ejuice with a single coil.

The flavor and cloud production of this tank are among the best you can get from a sub ohm tank and the coil choices give you plenty of options to try. All-in-all, the UFORCE-X is a great choice for any flavor-chasing vaper.

Read our full review on the VOOPOO UFORCE-X.

SAVE 10%

CODE: VERSED

Approx. Price: $20 USD

4.5

Outstanding

- Airflow: Dual Wide-Slot, Adjustable Top Airflow

- Tank Capacity: 5.5ml

- Available Coils:

- Z 0.15Ω (80-90W)

- Z XM 0.15Ω (70-85W)

- Z 0.20Ω (70-80W)

- Z 0.25Ω (45-57W)

- Z 0.40Ω (50-60W)

- Z XM 0.40Ω (50-60W)

PROS

- Modern and polished look

- Top to bottom airflow delivers great flavor and leak-resistance

- Wide airflow slots allow for plenty of airflow for the low-resistance, high wattage coils

- New Z XM coils are super flavorful

CONS

- Airflow control ring is very stiff at first (loosens up with continued use)

Why We Picked It

The Zeus Fli is a modernized and updated version of the Zeus Sub-Ohm Tank 2021. The most significant change is the top cap which pushes back and then flips up. It’s more secure than you might think and it takes considerable force to push it back, so it won’t easily open if you’re not intending to open it.

The Zeus Fli can hold up to 5.5ml of ejuice and is compatible with all Z series coils. The newest coils, the ‘XM’ coils, are super flavorful and hold their own against other top sub ohm tanks.

The Zeus Fli has “Top to Bottom” airflow, just like the Zeus 2021 tank. Airflow is immediately funneled from the top airflow holes and down through two large channels that lead straight to the coil. Its stellar performance, flavorful coils, and beautiful design are enough to earn the Zeus Fli a spot on our list.

Read our full review on the Geekvape Zeus Fli Tank.

SAVE 10%

CODE: VERSED

Approx. Price: $30 USD

4.5

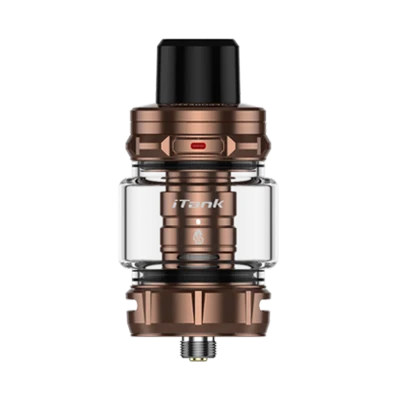

Outstanding

- Airflow: Dual Wide-Slot, Adjustable Bottom Airflow

- Tank Capacity: 8ml

- Available Coils:

- 0.15Ω Mesh Coil (75-90W)

- 0.20Ω Mesh Coil (60-75W)

- 0.40Ω Mesh Coil (50-60W)

- 0.50Ω Mesh Coil (30-40W)

PROS

- Clean, attractive design

- Delivers great flavor

- Secure top-fill port; lined with silicone to prevent leaking

- Huge 8ml tank capacity

- GTi coils are widely available and easy to find

CONS

- Only 4 coil options available

Why We Picked It

VAPORESSO is a vaping brand that is known for their excellent pod vapes, pod mods, and vape mods and kits. The iTank 2 is their latest subohm tank and although it comes included with a few of their mod/tank kits, the performance makes it worth purchasing as a standalone tank

The iTank 2 is a direct upgrade to the original iTank and improvements have definitely been made. One thing that has stayed the same is the huge 8ml capacity with the bubble glass installed, so you won’t have to fill up too frequently.

The top cap swivels back and opens upon pressing a button, revealing a self-closing silicone fill port. This button is very firm and takes direct and intentional pressure to open so accidentally opening it is unlikely, however you’ll still want to be careful.

The iTank 2 uses VAPORESSO’s GTi series of coils. These coils are made with VAPORESSO’s “COREX Heating Tech” and deliver excellent flavor, wicking capabilities, and coil lifespan. Included with the iTank 2 is a 0.2Ω coil and a 0.4Ω coil, however there are also 0.15Ω and 0.5Ω coils available to be purchased separately. These coils come in packs of 5 and they are readily available for purchase at many online vape stores for around $13.

Coils are plug-n-play and simply push or pull out of the base of the tank. You have to first unscrew the tank from the base to gain access to the coils but it’s all straightforward from there.

The performance of the iTank 2 firmly places it as one of the best tanks that we’ve used. The included coils deliver the best performance for this tank, but you can always try out the other coils for yourself and see if you like them; the options are there.

Read our full review on the VAPORESSO iTank 2.

SAVE 10%

CODE: VERSED

Approx. Price: $25 USD

4.0

Excellent

- Airflow: Three Wide-Slots, Adjustable Bottom Airflow

- Tank Capacity: 5ml

- Available Coils:

- 0.15Ω M8 coil (65-70W)

- 0.15Ω M6 coil (65-70W)

- 0.16Ω M2 coil (70-80W)

- 0.16Ω M1+ coil (75W)

- 0.15Ω M1 coil (70-80W)

- 0.38Ω M-Dual coil (80W)

- 0.15Ω M-Triple coil (80-85W)

- 0.20Ω F1 coil (80W)

- 0.20Ω F2 coil (80W)

- 0.20Ω F3 coil (70W)

PROS

- Professional design

- Top cap is secure and comes off with quarter turn

- Compatible with all Falcon F & M series coils

- Great, slightly restricted draw wide open; can be taken down to a restricted DL draw

- Great flavor and vapor production

CONS

- Guzzles ejuice

- AFC is very stiff at first (but loosens up over time)

- Coils are all low resistance; not a lot of variety in resistance and wattage requirements

Why We Picked It

HorizonTech is frequently praised as one of the best manufacturers of subohm tanks; the Falcon Legend proves why. The Falcon Legend encompasses what a great tank should be with its professional design, great airflow, excellent flavor, and wide range of available coils. In total, there are ten coils that can be used with this tank.

The Falcon Legend uses new M series coils which use bamboo pulp cotton for the wicking material for better wicking and flavor. You get two coils in the package, a 0.15Ω M8 coil (pre-installed), and a 0.15Ω M6 coil. In addition to these coils, the Falcon Legend is compatible with all other Falcon M and F series coils.

The two mesh coils that come with the Falcon Legend are very similar to one another. They’re both 0.15Ω resistance, and they’re both meant to vaped at around 65-70W. However, you can easily push these coils beyond their rated wattage, up to around 80-85W, without an issue. Both coils deliver fantastic flavor that is head and shoulders above most other tanks.

The Falcon Legend features a threaded top cap that comes off with a quarter-turn. It has enough resistance that it’s not going to come off accidentally, but there’s knurling that makes removal easy when you want to take it off. Overall, we found the top cap to be very secure.

The airflow on the Falcon Legend enters the tank through three adjustable, medium-sized slot airflow holes. The airflow with both coils is the same; a slightly restricted direct lung draw with the airflow open, and a restricted direct lung draw with the airflow closed down.

If you like to have no restriction with your tanks then the Falcon Legend may disappoint you. For anyone who likes a slight restriction to their draw though, the way the airflow hits wide open is perfect.

This tank is a great one overall from all aspects, with a clean design, lots of coil options, a nice draw, and good flavor. But buyer beware, the Falcon Legend guzzles ejuice so be prepared to purchase bottles more frequently.

Read our full review on the HorizonTech Falcon Legend.

SAVE 10%

CODE: VERSED

Approx. Price: $30 USD

4.0

Excellent

- Airflow: Dual Wide-Slot, Adjustable Top Airflow

- Tank Capacity: 5ml

- Available Coils:

- 0.16Ω Fine Mesh (70W)

- 0.17Ω Dual Mesh (70W)

- 0.40Ω Mesh (40W)

PROS

- Excellent flavor from both coils

- Air relief hole makes filling easier

- Top airflow channels air underneath the coil

- DL or RDL draw depending on the coil that you use

- Long coil life (75ml+)

- Does not leak at all

CONS

- Top cap is black for all colors

- Uses a lot of ejuice

- Coils can be difficult to remove without using the included tool

Why We Picked It

The Sakerz Master is yet another unique and capable sub-ohm tank by HorizonTech. It brings incredible clouds and flavor, as well as a clean and beautiful tank design. It has a 28mm base diameter, a 5ml max tank capacity, and it comes in 5 colors.

Like HorizonTech’s previous Falcon tanks, the Sakerz Master uses new coils that use wood pulp cotton as a wicking material and mesh as the heating element. These coils wick quickly, provide awesome flavor, and will last for 70ml+ of ejuice without showing any signs of giving out. These are some of the best coils around for flavor, clouds, and coil life.

Included with the Sakerz Master are two great coils: one 0.16ohm fine mesh coil and one 0.40ohm regular mesh coil. The fine mesh coil delivers a direct lung draw and superb flavor. The regular mesh coil isn’t quite as flavorful, but still holds its own against the majority of subohm tanks. This coil delivers a restricted direct lung draw that is really enjoyable to vape on.

The filling system on the Sakerz Master is quite easy to use. The top cap unscrews with a quarter turn to reveal a large fill port. The top cap is easy enough to remove but still secure enough that it won’t come off in your pocket.

The airflow on this tank is smooth, satisfying, and relatively quiet. This is a top airflow tank, but the airflow slots feed into two channels that funnel the airflow down to the bottom of the tank and under the coil. This gives you the flavor of a bottom airflow tank, but with the leak resistance of a top airflow tank.

It’s unique, it’s leak resistant, and the mesh coils deliver excellent flavor. The Sakerz Master is a great sub-ohm tank and it sits comfortably on our list as one of the best sub-ohm tanks in 2023.

Read our full review on the HorizonTech Sakerz Master.

SAVE 10%

CODE: VERSED

Approx. Price: $30 USD

4.0

Excellent

- Airflow: Three Medium-Sized Slots, Adjustable Bottom Airflow

- Tank Capacity: 5ml

- Available Coils:

- E2 0.16Ω Dual Mesh Coil (60-70W)

- P4 0.14Ω Quad Mesh Coil (60-70W)

PROS

- Machining is good and threading is smooth

- Easy to fill & change coils

- Excellent flavor from E2 and P4 coils

- Smooth airflow is free of turbulence

- Nice, dense draws at 60-70W

- Tank holds up to 5ml of ejuice

CONS

- Airflow is loud

- Coils drink ejuice quickly

Why We Picked It

HorizonTech has once again delivered an incredible tank for subohm vapers with the Aquila. The Aquila tank is a go-to subohm tank for the flavor chasers out there, delivering excellent flavor in a clean design.

The Aquila tank is available in 5 colors and uses mesh coils built with what HorizonTech calls their “Encircle” (E2) and “Quadruple” (P4) mesh structures, consisting of organic bamboo pulp cotton for the wicking material. These coils push and pull out of the bottom of the tank, making them very easy to replace.

The E2 coil, a dual mesh coil, is super flavorful and delivers great clouds all throughout the recommended wattage range of 60-70W. The P4 is not as flavorful as the E2 but still delivers an excellent vaping experience. The Aquila tank manages to get every last drop of flavor from your favorite ejuice, and it’s by far one of the most flavorful tanks yet.

This tank comes with a bubble glass pre-installed, which will hold up to 5ml of ejuice, and a spare straight glass in the package which can hold up to 3.5ml of ejuice. The drip tip is a standard 810 drip tip in black, no matter which color you purchase. It is quite comfortable but can be replaced with your own 810 drip tip.

The Aquila features a swivel top fill system that is very convenient. Simply press the button on the top cap and it will swing open, allowing you to fill your desired ejuice. The airflow on the Aquila is also great and enters the tank through three adjustable, medium-sized slot airflow holes. Whether you prefer a tight DTL draw or a more airy draw, the Aquila has got you covered.

Read our full review on the HorizonTech Aquila.

SAVE 12%

CODE: VERSED

Approx. Price: $30 USD

What is a Sub Ohm Tank?

A sub ohm tank is actually quite simple to understand. Simply put, a sub ohm tank is a tank that is meant to use premade, replaceable atomizers (coil +cotton) at less than 1.0 ohm. Sub ohm tanks are very user-friendly, and easily allow you to change the atomizers with factory-made ones that you can purchase from any reputable vape shop.

In addition to their ease of use, sub ohm tanks are also very easy to take apart and clean, have large tanks that will hold tons of ejuice, and will provide great flavor and huge clouds. All of these benefits mean that a good sub ohm tank is: low hassle, great to take on the go, and most importantly — a great performer.

Reasons to Use a Sub Ohm Tank

There are many reasons to use a sub ohm tank:

- Easy to use

- Convenient

- Great flavor

- Large vapor production

- Lots of airflow

Sub ohm tanks are much easier to use than any other type of vape tank. While rebuildable tanks like RDAs and RTAs require you to build your own coils, sub ohm tanks use coils that come ready to be used. All you have to do is screw or push the coil into the tank, fill your tank up with ejuice and wait for 5-10 minutes and you’re ready to vape!

The flavor produced by modern sub ohm tanks is amazing. Thanks to new advances in both tank and coil design, the best sub ohm tanks allow you to taste every note and nuance of your ejuices.

Last but not least, sub ohm tanks provide a lot of airflow and this results in huge clouds! If you’re a cloud chaser then a sub ohm tank is the way to go. Most tanks have at least two, if not three, wide airflow slots. This allows you to adjust the draw to exactly how you like.

Drawbacks to Using a Sub Ohm Tank

- Not meant for MTL vapers

- They use a lot of ejuice

- Not as cost effective as rebuildable tanks

The main drawback of a sub ohm tank is that they aren’t for vapers looking for a tight, MTL draw. The draw from most sub ohm tanks is going to be very airy. If you like the draw of a cigarette, you’re better off going with a pod vape.

Another drawback of using a sub ohm tank is that they use a lot of ejuice. Because sub ohm coils need a lot of wattage, they also vaporize a lot more ejuice with each draw. This results in more ejuice being used more quickly than it would be if you used a lower powered device. For this reason, finding a good cheap ejuice is recommended.

Lastly, sub ohm tanks aren’t as cost effective as rebuildable tanks. The coil for a sub ohm tank has to be changed every two weeks and buying coils can quickly add up. If you’re trying to be as cost efficient as possible, you can look into a tank that you can build your own coils for like an RDA, RTA or RDTA.

How Does a Sub Ohm Tank Work?

Sub ohm tanks use premade, replaceable coils to absorb and vaporize ejuice. These premade coils have a wicking material inside of them (usually cotton). Most sub ohm tanks have a port on the top of the tank that allows you to fill it with ejuice.

When your tank is filled with ejuice, the cotton absorbs ejuice through holes on the outside of the coil. The cotton will also pull in ejuice when you inhale on the mouthpiece as this creates suction; this is how the coil gets saturated with ejuice. When you press the fire button on your mod, the coil heats up and vaporizes the ejuice.

How to Use a Sub Ohm Tank

Sub ohm tanks are the most straightforward type of vape tank to use. Unlike rebuildable tanks, you don’t need any tools. All you need is the tank, a coil, and some ejuice.

It’s a good idea to prime your coil before inserting it into the tank. This is where you drop some ejuice into the holes on the outside of the coil to get it pre-saturated. For more information, check out our guide on how to prime a coil properly.

In order to insert the coil, you’ll need to disassemble the tank. Most tanks will unscrew from the airflow control ring at the bottom of the tank. With the tank apart, take your sub ohm coil and insert it into the tank. Depending on the tank, it might need to be screwed in or it might just push into the tank.

With the coil inserted, reassemble your tank. Now you can fill it up with ejuice. Most sub ohm tanks have the fill port located just underneath the top cap. Some top caps slide back, others unscrew, and some have a button release. Fill your tank up with ejuice and close the top cap. Wait for 5-10 minutes for the coil to fully saturate. Once the waiting period is over, you’re ready to vape.

Depending on the resistance of the coil, the best wattage to vape at will differ. Most coils have the recommended wattage printed on the outside of the coil. For the best experience, stay within this recommended wattage range.

Can I Use any Coil With Any Sub Ohm Tank?

No. While some sub ohm tanks are compatible with multiple types of coils, like the Hellvape Hellbeast sub ohm tank, it still can’t use just any coil. Most sub ohm tanks only work with one specific type of coil. For instance, if you purchase the Horizontech Falcon 2 sub ohm tank then you’ll need to use the Falcon 2 sector mesh coils.

What Is the Best Eliquid To Use In a Sub Ohm Tank?

Generally, higher VG ejuices are best in sub ohm tanks. This is because they’ll provide a smoother draw. Look for an ejuice with at least 60VG to use with your sub ohm tank.

What is the Best Wattage to Vape At With a Sub Ohm Tank?

Depending on the resistance of the coil, the best wattage to vape at will differ for each coil. Most coils have the recommended wattage printed on the outside of the coil. For the best experience, stay within this recommended wattage range.

What Nicotine Strength Ejuice Should I Use In my Sub Ohm Tank?

Using too high of a nicotine strength will result in harsh draws that will hurt your throat. It’s recommended that you use a 0mg, 3mg, 6mg or 9mg nicotine strength ejuice with sub ohm tanks.

How Long Does a Sub Ohm Coil Last?

All coils are different and so the amount of time they’ll last varies, but you can generally expect to get 1-2 weeks out of a sub ohm coil.

Coil life also depends on the wattage that you vape at and the type of ejuice that you use. Ejuices with a lot of sweetener will severely gunk up your coils and cut their usage times short. Similarly, exceeding the recommended wattage of your coil will also cut the usage time considerably.

What’s Better: a Sub Ohm Tank or an RDA?

While sub ohm tanks are meant to be used with factory-made, prebuilt atomizers and come with a tank that allows you to fill it with ejuice and vape away, RDAs are quite a bit different. With an RDA, you have to build your own coils with your own vape wire and cotton, and there isn’t really a “tank” like sub ohm tanks. Instead, you’ll have to drip your juice into the RDA every so often in order to continue vaping without any dry hits. If you want to learn more about RDAs you can read our article here.

Let us help you

Have a question or a comment? Need help? Even if you just want to share your love for vaping. Send us an email! We would love to hear from you!